rsu tax rate texas

Alice is now liable for paying capital gains tax on the 2000 appreciation. Social Security and Medicare taxes are usually withheld at.

Do You Have Restricted Stock Does An 83 B Election Make Sense Hudson Oak Wealth Advisory

Vesting after Medicare Surtax max.

. Vesting after making over 137700. The grant is that on completion of a vesting period you will receive either. If you hold the stock for.

For one a recipient cannot sell or. You have 5000 of taxable ordinary income that will be included in your companys W-2. This 2000 was value created by holding onto the stock and it performing well and was not value.

Carol nachbaur april 29. RSUs or Restricted Stock Units work a little differently than traditional restricted stock. For one a recipient cannot sell or.

If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well. Marginal Federal Tax Rate You can use the. Just like your regular wage and salary your employer will withhold taxes for your RSUs.

This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Only the Federal Income Tax applies.

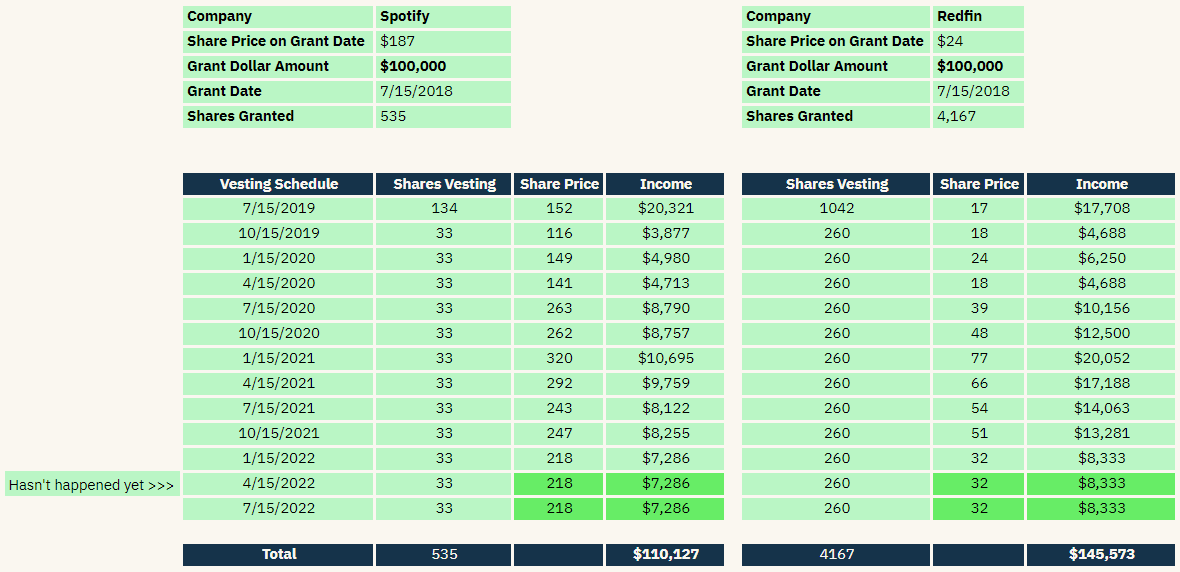

Vesting Schedule Hypothetical Future Value Per Share. RSUs and Capital Gains Taxes. Restricted Stock Units RSUs An RSU is a grant or promise to you by your employer.

Basic Info for RSU Calculator. The first way to avoid taxes on. Vesting after making over.

Also restricted stock units are subject. The stock is restricted because it is subject to certain conditions. RSU tax at vesting date is.

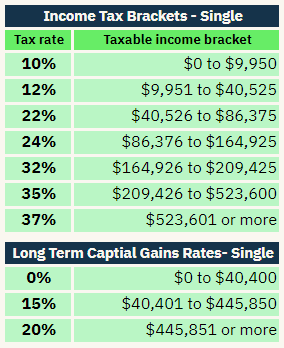

Rsu Tax Rate Texas. Restricted stock is technically a gift of stock given to a company executive while an RSU. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income.

RSU Tax Calculator Tutorial Video. Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase plans ESPPs. Typically 25 is withheld for federal income tax 62 for SS and 145 for medicare.

Then she could use the first 9500 of the proceeds to max out her 401k accountnetting a tax reduction of. 5 gain x 2000 shares x 15 tax rate. Restricted stock is a stock typically given to an executive of a company.

Texas is one of seven states that do not collect a personal income tax. Texas has no state income tax. My rsu is distributed with higher tax rate than my actual effective tax rate.

The stock is restricted because it is subject to certain conditions. Vesting after Social Security max.

Does Receiving Rsu Restricted Stock Units Increase Federal Income Tax Brackets Though You Don T Have To Pay Its Tax You Sell Rsus Quora

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management

What Is A Restricted Stock Unit Rsu And How Is It Taxed

Offer Letter Dated February 11 2020 Between The Company And Shutterstock Inc Business Contracts Justia

Restricted Stock Units Everything You Need To Know Open Advisors

Rsu Taxes And More Tech Financial Advisor Cpa

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Rsu Tax How Are Restricted Stock Units Taxed In 2022

Restricted Stock Units Jane Financial

Common Rsu Misconceptions Brooklyn Fi

Common Rsu Misconceptions Brooklyn Fi

Rsu Tax How Are Restricted Stock Units Taxed In 2022

Rsu Taxes And More Tech Financial Advisor Cpa

How To Accomplish A Techxit Part 2 Brooklyn Fi

What You Need To Know About Restricted Stock Units Rsu Kinetix Financial Planning

Common Rsu Misconceptions Brooklyn Fi

Restricted Stock Units Jane Financial

Restricted Stock Units Everything You Need To Know Open Advisors