nc estimated tax payment voucher

NC-3 and withholding statements. Individual Income Tax Forms Instructions.

Legal Archives Templatelab Separation Agreement Template Separation Agreement Divorce Agreement

GSA cannot answer tax-related questions or provide tax advice.

. You will need your student id and specific course enrolled in to make this payment. Payments to the health care trust funds For payment to the Federal Hospital Insurance Trust Fund and the Federal Supplementary Medical Insurance Trust Fund as provided under sections 217g 1844 and 1860D-16 of the Social Security Act sections 103c and 111d of the Social Security Amendments of 1965 section 278d3 of Public Law 97. The minimum required estimated tax payment is the greater of 50 of the prior year elective tax paid or 1000.

Home File Pay Taxes Forms. Partnership Income Payment Voucher. To mail a tax payment make your check or money order payable to United States Treasury.

Diary of a black woman. The Electronic Federal Tax Payment System EFTPS is a free service from the US. Individual income tax refund inquiries.

A The Commission shall keep a record showing in detail all receipts and disbursements. RPD-41375 NOL Carryforward Worksheet for Fiduciary Income Tax. Skip to main content Menu.

Verification of estimated tax payments on a module without a filed return can be made to the secondary taxpayer when the preceding year shows a joint return with that same secondary taxpayer and Remittance Transaction Register RTR shows the joint ES voucher or joint check showing the intent to make joint ES payments. FID-ES Fiduciary Income Estimated Tax Payment Voucher. Minnesotas 2022 income tax ranges from 535 to 985.

Schedule NC K-1 Supplemental Schedule. Get a Free Tax Relief Consultation. Department of the Treasury that replaced the Federal Tax Deposit system FTD in 1996 per 6311.

Enter Your Information Below Then Click on Create Form to Create the Personalized Form NC-40 Individual Estimated Income Tax. RPD-41353 Owners or Remittees Agreement to Pay Withholding on behalf of a Pass-through Entity or Remitter. Canadian H-D Dealers towards the purchase of.

Withholding NC-5 NC-5P. Book free or paid RT PCR Antigen Antibody COVID Flu Respiratory tests with ease and get results quickly. Schedule TC-38 Solar Energy or Small.

Under current law the payment rule applies only to a hospital that was classified as an LTCH as of a specified date. Alabama expects you to pay income tax quarterly if you owed 500 or more on your previous years tax return. Please be sure you use the correct semester form or your payment may not post correctly.

Have a question about per diem and your taxes. Records of receipts and disbursements. Be sure to include your name address phone number taxpayer ID number Social Security Number or Employer Identification Number the tax period and the related tax form or notice number on your form of payment.

This home is located at 1141 Southshore Diamond Lake Rd Newport WA 99156 and is currently estimated at 1136164 approximately 671 per square foot. Who e-file a federal tax return or extension request can elect to have their bank account debited for balance due or estimated payments. 15007 In addition the bill amends the Pathway for SGR Reform Act of 2013 to expand to all LTCHs the application of a payment rule that requires the exclusion of certain patients for purposes of calculating length of stay.

62-1103 all license fees and seal taxes all money received from fines and penalties and all other fees paid into the office of the Utilities Commission shall be. Application for Extension for Filing Partnership Estate or Trust Tax Return. However for tax years beginning on or after January 1 2022 and before January 1 2026 the pass-through entity will be required to make minimum estimated tax payments on or before June 15.

See IRM 317277241. Best COVID-19 testing center in Greensboro NC. If you are delayed due to lost luggage phone the number on the voucher or have a companion exit the Customs Area to advise the transfer.

You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding. Federal tax credit may be 10 of the cost of the qualified vehicle up to 2500. This property was built in 1940.

75 USD 100 CAD Voucher valid at participating US. Clifford alarm valet switch payment status in oracle payables r12. If for any reason you do not connect with the Gate 1 transfer personnel go to the Tourist Information Desk and ask them to page the Gate 1 Travel representative or phone the number on your voucher.

This page has the latest Minnesota brackets and tax rates plus a Minnesota income tax calculatorIncome tax tables and other tax information is sourced from the Minnesota Department of Revenue. Sales Use E-500 E-536. Income Amended D-400V Amended.

Estimated from fuel economy tests on a sample motorcycle from the corresponding family conducted by Harley-Davidson under ideal laboratory conditions. Form 40ES is an estimated tax worksheet that will allow you to calculate your estimated quarterly income tax payments. Social Security Notice Attorney Fee Payment HHS-483 Voucher For Payment And Release SSA-483 SSA-488 Microfiche Quality Review SSA-L489-U4 Refiling Of Magnetic Tapes SSA-491-TC Third Party Query Input SSA-491-TC1 Mtpqy Input SSA-492 Psc Case Folder SSA-493 Security Termination Statement SSA-494 Building PaSS Psc And Doc HA-497 Court Case Control.

Mini sheepadoodles for sale in nc. Dates of each semester are listed in from of payment form link for your convenience. B Except as provided in GS.

Please contact the Internal Revenue Service at 800-829-1040 or visit wwwirsgov. 82019 - 121819 2019 Fall semester delinquent dual credit enrollment fee. 2022 AREA PROGRAM INCOME LIMITS Effective Dates Revised Date Low Income - 80 Housing Voucher and Tax.

The price for the Rapid COVID-19 IgGIgM Antibody Test Service includes payment for medical oversight collection site infrastructure performance of sample collection test materials. You need to file form 80-300 with the Mississippi Department of Revenue on a quarterly basis.

Catering Event Order Form Template Luxury Banquet Event Order Sample Google Search Event Planning Guide Event Event Planning Printables

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

Visit Http Www Reference180 Com Incorporate In California To Download The Free California Corporation Quick Start Guide And Get Fo Corporate Form Instruction

Printable Pressure Washing Contract Template Fresh Pressure Washing Pressure Washing Estimate Estimate Template Pressure Washing Business Pressure Washing

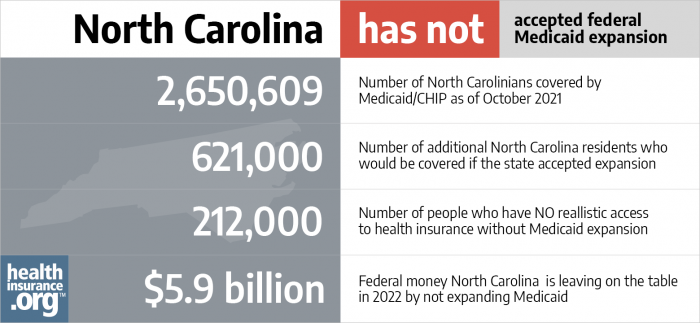

Aca Medicaid Expansion In North Carolina Updated 2022 Guide Healthinsurance Org

How To Track The Progress Of Your North Carolina Tax Return

North Carolina State Tax Refund Status Nc Tax Brackets Taxact

Real Estate Checklist Listing Real Estate Forms Realtor Etsy Real Estate Checklist Real Estate Forms Real Estate Agent Listings

Budget Planning Concept Accountant Wear Mask Is Calculating Company S Annual Tax Calendar 2021 And Persona In 2022 Tax Deadline Budget Planning Estimated Tax Payments

Accounting Tax Preparation Payroll Accounting Services Payroll Income Tax

Home Inspection Report Fillable Printable Pdf Forms Handypdf Regarding Pre Purchase Building Inspection Report T Report Template Home Inspection Best Templates

Sample Wedding Contract Certificate How To Draft A Wedding Contract Certificate Downloa Separation Agreement Template Separation Agreement Contract Template

City Income Tax Return For Individuals Spreadsheet Tax Return Income Tax Income Tax Return

Online File Pay Sales And Use Tax Due In Multiple Counties In Nc Youtube